The Small Business Administration (SBA) has three loan programs to help U.S. exporters. Because most banks do not advance cash against foreign receivables, the SBA export loan guarantees were created to help to fill this funding gap.

The three SBA export loan programs

SBA export loans are, simply put, bank loans guaranteed by the SBA. Unlike other SBA loan guarantees that range from 50% to 75% of the loan amount, SBA Export Loans guarantee up to 90% of the loan. All of the three loan programs below can be used to finance direct or indirect export activities. Indirect exports can include tourism and the sale of goods to domestic customers who then export them.

To find the SBA export contact for your area click here.

1. SBA Export Working Capital Program (EWCP):This program encourages exporting by guaranteeing cash advances linked to an exporter’s export orders and receivables. These loans can be issued as term loans or lines of credit, though they are most frequently issued as lines of credit. Proceeds can be used to finance suppliers, inventory and goods production related to export activities; they’re intended to help exporters deal with long payment cycles. Armed with the guarantee from the SBA through EWCP, U.S. exporters can better compete for overseas business by extending liberal sales terms, especially in underdeveloped markets that face high cost barriers for importers. The program is distinguished by its quick processing times and low fees.

2. SBA Export Express Program is a fast-track loan guarantee program for smaller export-related loans. The lender’s proprietary collateral and underwriting standards apply to these loans, which can be used for any export development activity, including market development, acquisition of fixed assets to support export sales and refinancing of existing export loans. These loans can be issued as term loans or lines of credit. The Express Loan Program is the most flexible and simplest of the SBA export loan programs.

3. SBA International Trade Loan (ITL):This program supports companies that are expanding due to exports or that are adversely impacted by imports. The program makes loans secured by equipment, real estate and permanent working capital, and it can be used to refinance existing loans. These loans can also be used to buy, build or remodel facilities and equipment involved in international trade, or for working capital. ITL loans are similar to the conventional SBA 7(a) loans except for a higher loan guarantee percentage.

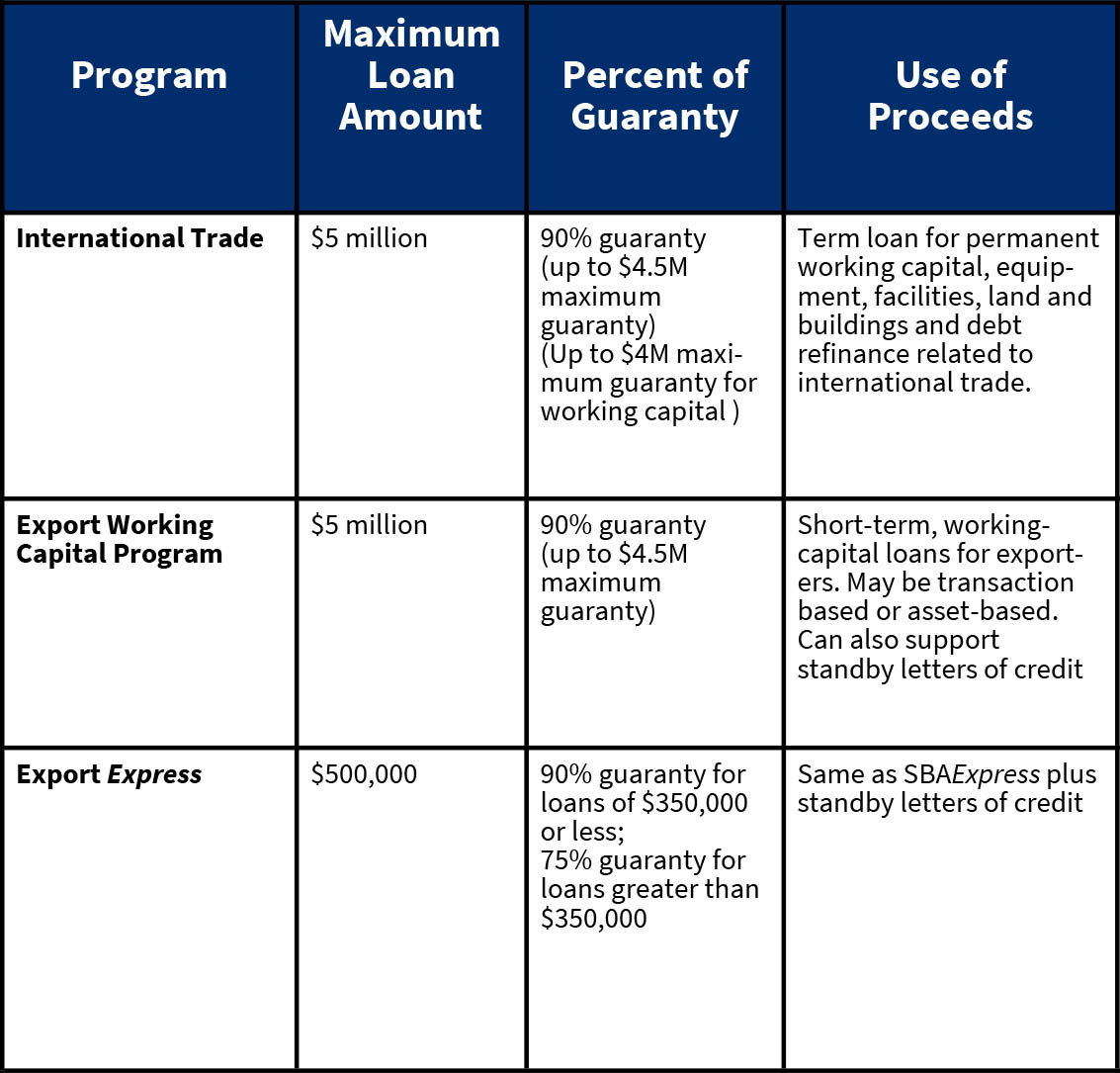

Rates, Terms and Loan Amounts

The following table summarizes the rates, loan amounts and terms for the three SBA export loan programs.

Collateral and Personal Guarantee Requirements

Almost every SBA loan program requires a personal guarantee from all owners with at least a 20% share in the business. Collateral requirements, on the other hand, vary from loan program to loan program.

Eligibility Criteria

The standard SBA eligibility requirements apply to SBA export loans (see these eligibility criteria in this article about SBA 7(a) Loans). The SBA export loan programs apply to firms with any export development activity, and they have additional criteria:

1. SBA Export Working Capital Program:You must have at least 12 months’ worth of operating experience before applying—though this can be waived if the you have demonstrated export expertise and previous business experience.

2. SBA Export Express Loan Program:You must have been in business for at least one year, must be entering or expanding in an existing foreign market and must not be financing offshore operations. You must provide a detailed export business plan predicting first-year export sales and describing how the loan proceeds will be used. The one-year-in-business requirement can be waived if the business’s key personnel have demonstrated export expertise and previous successful business experience.

3. SBA International Trade Loan: Businesses must show that the loan will facilitate entry expansion into an export market or that the business has been hurt by import competition, and that the loan will allow the business to improve its competitive position. You may be required to provide an export business plan that includes expected export sales and financial statements.

Application Process

You’ll need certain documents to accompany your loan application form, including your ownership and affiliate information, SBA loan application history, employee headcount and job creation information. Lenders usually want to see previous and projected financial reports, tax returns and your business plan. Here is a quick synopsis of the application processes for SBA Export Loans:

1. SBA Export Working Capital Program: Before you apply to the program, the SBA encourages you to contact its staff at a U.S Export Assistance Center (USEAC) to discuss the eligibility and suitability factors for the loan. The participating lender reviews and approves the application, then submits the guarantee request to the SBA USEAC location responsible for the exporter’s region. The SBA requires a completed Form SBA-EIB 84-1, plus any attachments or other SBA forms needed, to apply. The application decision from the SBA is given within five to 10 business days.

2. SBA Export Express Loan Program: Apply directly to an SBA Express lender by completing the lender’s forms and the SBA’s Borrower Information Form (SBA Form 1919). Lenders send approved applications to the SBA’s National Loan Processing Center, which will provide an answer within 24 hours, meaning you can expect funding within a week.

3. SBA International Trade Loan: The borrower applies to an SBA-participating lender by filling out all the lender’s forms. The SBA generally requires the same forms for the ITL loan program as the SBA 7(a) loan program. This may include the Borrower Information Form (Form 1919) and Personal Financial Statement (Form 413). If you are claiming adverse impact from import competition, you must document the nature of the impact and how the loan will improve your competitive position. The SBA will generally give a decision within five to 10 business days.

To find an SBA-affiliated lender in your area, you can use the SBA’s Lender Match tool on its website. Generally, the SBA is quicker to approve a loan guarantee than a lender is to approve the loan. For this reason, you should anticipate your need for a loan by at least a few months. The exception is the SBA Export Express Loan, which can be turned around in a week or less.

To see a webinar in SBA export loan programs click here

or for a pdf flyer click here.