Anytime you ship goods overseas, you first need to determine their Harmonized Code. This code helps determine if your products are subject to U.S. export controls, and what import duties the destination country may charge.

–

What is an HS or Schedule-B number?

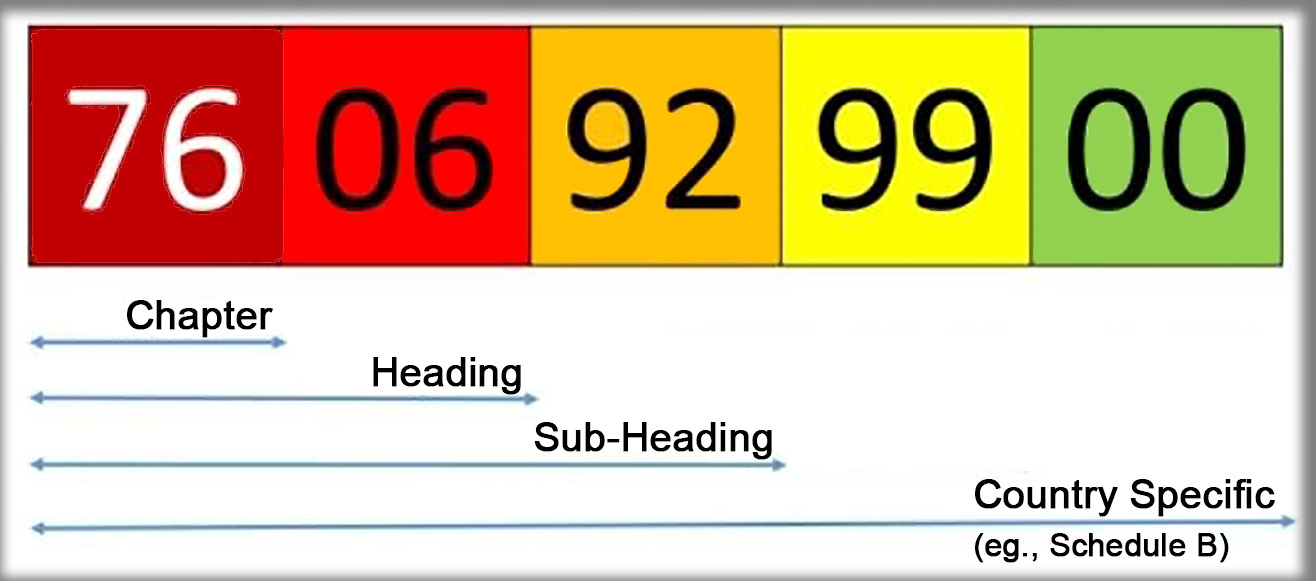

HS Numbers (short for Harmonized System Classification) are 10-digit codes used to classify products traded internationally, and are used by customs authorities around the world for assessing duties and taxes. The coding system is maintained by the World Customs Organization (WCO), based in Brussels, with over 200 member countries. Additional digits are added to the HS number by governments to further distinguish products in certain categories.

Schedule-B numbers are used only for US imports and exports. Here, the US Census Bureau adds the last 4 digits for more precise product classification.

Why you need to know your product’s HS/ Schedule B numbers

Exporters need to know their product classification, i.e., Schedule B and HS numbers for many reasons including:

- Classifying physical goods for shipment to a foreign country;

- Determining import tariff (duty) rates and figuring out if a product qualifies for a preferential tariff under a Free Trade Agreement (HS number);

- Filing the Electronic Export Information (EEI);

- Completing shipping documents, such as shipper’s letter of instructions, commercial invoice or certificate of origin. (HS number);

- Conducting market research including analyzing trade statistics.

How to find your Code?

To find your product classification number (Schedule B/ HS Code start with watching an Instructional video or looking up the schedule B code by using Schedule B Search Engine.

After viewing the video, if you are still unsure of the best Schedule B code for your product, phone U.S. Government commodity classification experts at 1-800-549-0595, option 2.

To download full Schedule-B code books and other details, click here. Additional information: eCommerce Harmonized Systems codes.

| The Schedule B search engine allows you to locate the full 10-digit level Schedule B code. The full 10 digit code is required for your EEI filing, when applicable. To look up tariff/duty rate for your product, Consult tariff resources such as Customs Info Database (CI) and FTA Tariff Tool. Use only the first 6 digits of the Schedule B code to find tariff (duty) rates. The CI and The FTA Tariff Tool will allow you to see the full foreign country HS code. |